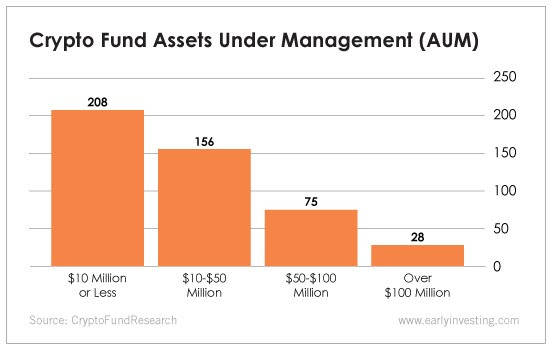

The chart above reflects the world as we know it - at least regarding institutional investors and cryptocurrencies.

According to Crypto Research Fund, there are more than 460 crypto investment funds. That number includes hedge funds, venture capital funds, and a few ETFs and private equity funds.

The distribution of these funds is interesting.

Currently, the bulk of the

funds have less than $50 million in assets under management (AUM). And

funds with fewer than $10 million AUM make up more than 40% of the

market.

Currently, the bulk of the

funds have less than $50 million in assets under management (AUM). And

funds with fewer than $10 million AUM make up more than 40% of the

market. That's pocket change for traditional hedge funds. And that's why we're so excited about the building institutional boom in crypto.

Imagine a world where this chart is reversed - a world where 208 funds have more than $100 million AUM and just 28 have fewer than $10 million in AUM. That's billions of dollars injected into the crypto markets. And that's the world we're headed toward - only bigger.According to Crypto Research Fund, in January of 2016, crypto funds had $190 million AUM. As of July of this year, that number is at $7.1 billion. And that growth happened in the absence of regulations, tried-and-true custody solutions and ETFs, which are generally prerequisites for institutional investors to join the market.

But that's changing. The parent company of the New York Stock Exchange (Intercontinental Exchange) is building a cryptocurrency trading platform that includes a custody solution. We're moving closer to the approval of a bitcoin ETF. It's a matter of when, not if. Coinbase launched a custody solution for institutional investors earlier this year. Like I said, it's when, not if.

There's a wave of institutional money getting ready to flood the crypto markets. Don't miss your chance to buy into the market early. This chart is just a hint of what the future holds

Il grafico qui sopra riflette il mondo come lo conosciamo,

almeno per quanto riguarda gli investitori istituzionali e le criptovalute. Secondo Crypto Research Fund, ci sono oltre 460 fondi di investimento criptati. Questo numero comprende hedge fund, fondi di venture capital e alcuni ETF e fondi di private equity. La distribuzione di questi fondi è interessante. Attualmente, la maggior parte dei fondi ha meno di $ 50 milioni di asset under management (AUM). E i fondi con meno di $ 10 milioni di AUM rappresentano oltre il 40% del mercato. Questo è un cambiamento in tasca per i fondi hedge tradizionali. Ed è per questo che siamo così entusiasti del boom istituzionale dell'edificio in cripto.

Immagina un mondo in cui questo grafico è invertito: un mondo in cui 208 fondi hanno più di $ 100 milioni di AUM e solo 28 hanno meno di $ 10 milioni in AUM. Sono miliardi di dollari iniettati nei mercati criptati. E questo è il mondo verso cui siamo diretti - solo più grandi.

Secondo Crypto Research Fund, a gennaio 2016, i fondi criptati avevano $ 190 milioni di AUM. A luglio di quest'anno, tale numero è pari a $ 7,1 miliardi. E quella crescita è avvenuta in assenza di regolamenti, soluzioni di custodia provate e veritieri e ETF, che sono generalmente i presupposti per gli investitori istituzionali per entrare nel mercato.

Ma questo sta cambiando. La casa madre della Borsa di New York (Intercontinental Exchange) sta costruendo una piattaforma di trading di criptovaluta che include una soluzione di custodia. Ci stiamo avvicinando all'approvazione di un ETF bitcoin. È questione di quando, non se. Coinbase ha lanciato una soluzione di custodia per investitori istituzionali all'inizio di quest'anno. Come ho detto, è quando, non se.

C'è un'ondata di soldi istituzionali pronti a inondare i mercati cripto. Non perdere l'occasione di acquistare sul mercato presto. Questo grafico è solo un suggerimento su ciò che riserva il futuro.

Immagina un mondo in cui questo grafico è invertito: un mondo in cui 208 fondi hanno più di $ 100 milioni di AUM e solo 28 hanno meno di $ 10 milioni in AUM. Sono miliardi di dollari iniettati nei mercati criptati. E questo è il mondo verso cui siamo diretti - solo più grandi.

Secondo Crypto Research Fund, a gennaio 2016, i fondi criptati avevano $ 190 milioni di AUM. A luglio di quest'anno, tale numero è pari a $ 7,1 miliardi. E quella crescita è avvenuta in assenza di regolamenti, soluzioni di custodia provate e veritieri e ETF, che sono generalmente i presupposti per gli investitori istituzionali per entrare nel mercato.

Ma questo sta cambiando. La casa madre della Borsa di New York (Intercontinental Exchange) sta costruendo una piattaforma di trading di criptovaluta che include una soluzione di custodia. Ci stiamo avvicinando all'approvazione di un ETF bitcoin. È questione di quando, non se. Coinbase ha lanciato una soluzione di custodia per investitori istituzionali all'inizio di quest'anno. Come ho detto, è quando, non se.

C'è un'ondata di soldi istituzionali pronti a inondare i mercati cripto. Non perdere l'occasione di acquistare sul mercato presto. Questo grafico è solo un suggerimento su ciò che riserva il futuro.

Nessun commento:

Posta un commento